Oracle® Insurance Policy Administration 9.5.0.0 E23638_01

Withholdings are specific amounts or percentages that can be held from disbursements that are subject to state and federal taxes. Withholding only applies to plans with taxable events, such as a Variable Annuity.

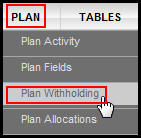

All plan withholding data can be viewed in OIPA from the Plan menu, when the Plan Withholding option is selected.

Plan Menu and Plan Withholding Option

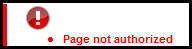

Security is assigned to the Plan Fields, Plan Withholding and Plan Allocation options on the Plan menu in order to control user access to this information. If a user is not assigned the proper security access, then a Page Not Authorized error will occur.

Page Not Authorized Error for Plan Data

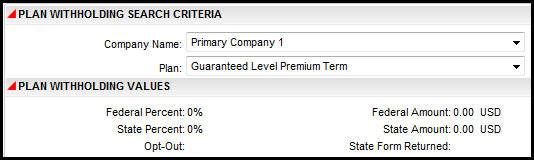

The information displayed is read only and may not be updated.

Plan Withholding Values Displayed in OIPA

Copyright © 2009, 2012, Oracle and/or its affiliates. All rights reserved. Legal Notices